银行产品经理 英文,银行产品经理英文

银行产品经理 英文

What Does a Bank Product Manager Do?。

As a bank product manager, you are responsible for overseeing the development and launch of new banking products and services, as well as managing the lifecycle of existing products. You will work with a team of engineers, designers, and marketers to bring new products to market, and you will be responsible for ensuring that those products are successful. Responsibilities

The responsibilities of a bank product manager include:

Conducting market research and identifying customer needs。

Developing product roadmaps and timelines。

Managing the development of new products and services。

Coordinating with engineers, designers, and marketers to bring new products to market。

Launching new products and services。

Managing the lifecycle of existing products。

Monitoring the performance of products and making adjustments as needed

What is the Average Salary for a Bank Product Manager?。

The average salary for a bank product manager in the United States is $120,000 per year. However, salaries can vary depending on experience, location, and company size. Skills and Qualifications

To be successful as a bank product manager, you will need to have the following skills and qualifications:

A bachelor's degree in business administration or a related field。

3 years of experience in product management。

Strong understanding of the banking industry。

Excellent communication and interpersonal skills

What is the Job Outlook for Bank Product Managers?。

The job outlook for bank product managers is expected to be good in the coming years. As banks continue to develop new products and services to meet the changing needs of their customers, they will need skilled product managers to oversee these efforts. Tips for Finding a Job as a Bank Product Manager

If you are interested in becoming a bank product manager, here are a few tips for finding a job:

Network with people in the banking industry。

Attend industry events。

Apply for jobs online。

Use a recruiter

Conclusion。

If you are looking for a challenging and rewarding career, then becoming a bank product manager may be the right choice for you. With the right skills and experience, you can succeed in this role and help banks to develop new products and services that meet the needs of their customers.

银行产品经理英文

Itroductio

I the rapidly evolvig digital bakig ladscape, the role of the bak product maager (BPM) has become icreasigly crucial. These professioals are resposible for drivig iovatio, ehacig the customer experiece, ad esurig the success of digital bakig products ad services.

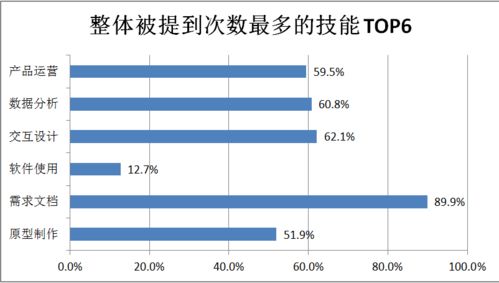

Essetial Skills for Bak Product Maagers

To excel as a BPM, oe must possess a array of skills, icludig:

Strog uderstadig of bakig products ad services

Expertise i user experiece (UX) desig ad customer research

Proficiet i agile developmet methodologies

li>Ability to aalyze data ad market treds

Resposibilities of Bak Product Maagers

BPMs are resposible for various tasks, such as:

Idetifyig ad prioritizig product opportuities

Defiig the product roadmap ad strategy

Collaboratig with cross-fuctioal teams to develop ad lauch products

Moitorig product performace ad makig data-drive decisios

Challeges Faced by Bak Product Maagers

BPMs ecouter several challeges, icludig:

Keepig up with the rapid pace of techological chage

Balacig stakeholder iterests ad meetig regulatory requiremets

Maitaiig a focus o customer eeds while drivig busiess results

The Future of Bak Product Maagemet

The future of bak product maagemet is promisig, with the emergece of ew techologies ad the growig importace of customer experiece. BPMs who embrace iovatio, data aalytics, ad agile methodologies will be well-positioed to lead the digital bakig revolutio.

Coclusio

The role of the BPM is vital to the success of baks i the digital age. By leveragig their expertise ad embracig the latest treds, BPMs ca drive iovatio, ehace the customer experiece, ad positio their orgaizatios for log-term growth.

Tags: Bak Product Maager, Digital Bakig, Product Maagemet, Customer Experiece, Iovatio

银行的产品经理

银行的产品经理:职责与挑战

银行的产品经理是银行业中一个关键的职位,他们负责开发、管理和推广各种金融产品,以满足客户需求并实现银行的业务目标。本文将介绍银行的产品经理的职责和面临的挑战。

产品策划与开发

银行的产品经理负责制定产品策略和规划,并参与产品的设计与开发过程。他们需要根据市场需求和竞争情况,不断地创新和优化产品,确保产品的竞争力和市场占有率。

市场调研与分析

产品经理需要进行市场调研和竞品分析,了解客户需求和市场动态,为产品的开发和推广提供数据支持和参考。他们需要密切关注市场变化,及时调整产品策略和方向。

推广与营销

一旦产品开发完成,产品经理需要负责产品的推广和营销工作。他们需要制定推广计划和营销策略,与营销团队合作,开展各种宣传和推广活动,提升产品的知名度和销售额。

风险管理与合规

在产品开发和推广过程中,产品经理需要密切关注风险管理和合规要求。他们需要确保产品的合法性和安全性,遵循监管政策和法律法规,防范和化解各种风险。

客户关系维护

产品经理需要与客户保持密切的沟通和合作,了解客户需求和反馈,及时调整和改进产品。他们需要建立良好的客户关系,提升客户满意度和忠诚度。

面临的挑战

银行的产品经理面临着市场竞争激烈、监管要求严格、客户需求多样化等挑战。他们需要不断学习和提升自己的能力,适应市场变化和挑战,保持竞争力和创新性。

结语

银行的产品经理是银行业中一个重要的职位,他们负责产品的开发、管理和推广,面临着各种挑战和机遇。通过不断学习和提升自己的能力,产品经理可以更好地应对市场变化和挑战,实现个人和银行的共同发展。

银行产品经理职能

银行产品经理的职能

银行产品经理是金融业中的关键角色,负责管理金融机构的产品生命周期。他们的主要职责包括:

市场调研

银行产品经理进行市场调研以了解客户需求、竞争环境和行业趋势。他们分析数据、开展访谈并与客户和利益相关者合作,以确定产品机会。

产品开发

基于市场调研结果,银行产品经理设计和开发新产品或改进现有产品。他们定义产品功能、特性和定价策略,并确保产品符合监管要求。

标签:产品开发、市场调研

产品管理

银行产品经理管理产品的整个生命周期,包括从推出到退市。他们监控产品绩效、收集客户反馈并进行必要的调整,以确保产品持续满足客户需求。

标签:产品管理、客户反馈

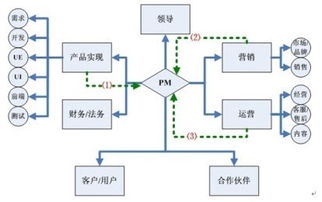

利益相关者管理

银行产品经理与内部和外部利益相关者合作,包括高管、业务部门、监管机构和客户。他们沟通产品策略、收集反馈并建立关系以确保产品成功。

标签:利益相关者管理、沟通

技术专长

银行产品经理通常具有技术背景,能够理解金融技术和支付系统。他们与技术团队合作,确保产品与银行的IT基础设施无缝集成。

标签:技术专长、金融科技

合规与风险管理

银行产品经理必须遵守适用的监管法规和合规要求。他们评估产品风险、实施缓解措施并与法律和合规团队合作,以确保产品合规。

标签:合规、风险管理 (随机推荐阅读本站500篇优秀文章点击前往:500篇优秀随机文章)